The Kenya Revenue Authority (KRA) has reaffirmed its commitment to build a future-ready workforce and strengthen succession planning for the next generation of tax administrators through the reintroduction of its graduate trainee programme.

The programme, anchored at the Kenya School of Revenue Administration (KeSRA), aims to accelerate digital transformation in tax administration, deepen institutional partnerships, and develop in the next generation of tax revenue administrators.

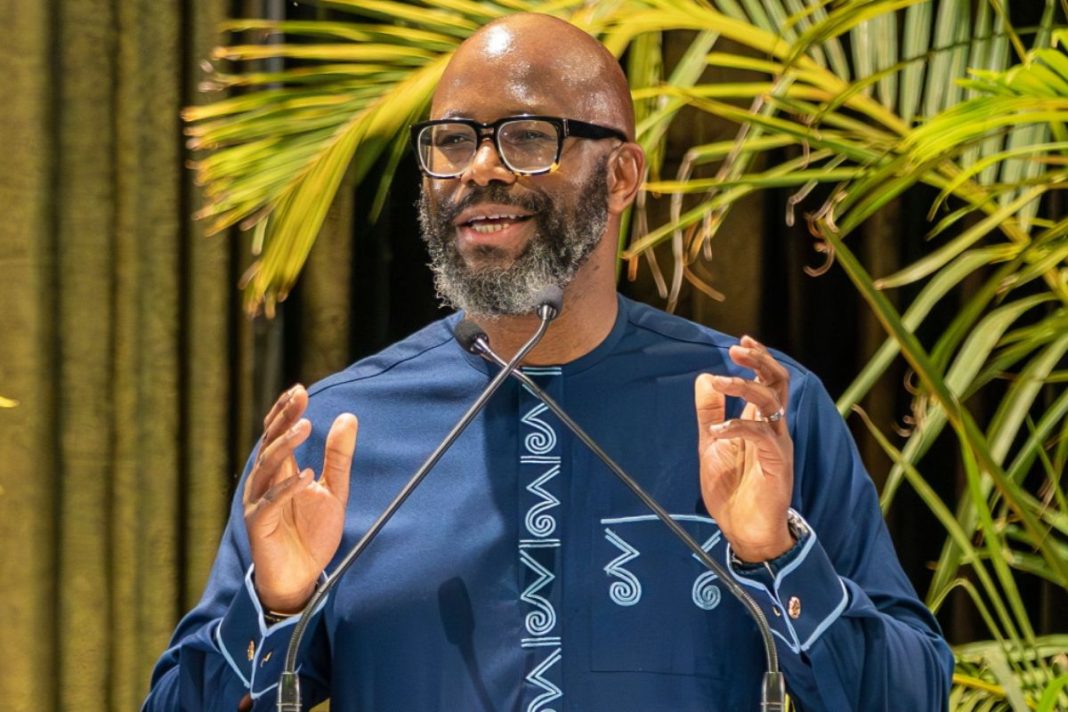

Speaking during the 22nd KeSRA Graduation Ceremony themed “Future Ready: Enhancing Digital Skills for Simplified Revenue Administration,” KRA Commissioner General, Humphrey Wattanga underscored KRA’s commitment to invest in people development as an integral component to KRA’s ongoing digital transformation agenda.

“Through KESRA, more than 5,000 KRA staff have been trained this financial year, and we are now reintroducing the Graduate Trainee Programme to strengthen succession planning and build leaders capable of navigating the complexities of modern tax systems.” said Mr. Wattanga.

The Commissioner General expressed confidence that the graduating cohort of 674 students will play a critical role in boosting compliance, expanding the tax base, and enhancing service efficiency.

He said the training will equip graduates to enhance KRA’s key service delivery platforms, including electronic Tax Invoice Management System (eTIMS), the iwhistle whistle-blower portal, the Integrated Customs Management System (iCMS), integrated Tax Management System (iTAX), which collectively enable real-time data exchange, automation, improved compliance, and more seamless and simplified taxpayer experiences.

“As we deepen our digital transformation agenda, we require a highly skilled workforce that can innovate, adapt, and lead. KESRA has been empowered and continues to produce the professionals needed to drive a transparent, data-driven and future-ready tax administration,” he said.

KRA Board Chairman, Hon. Ndiritu Muriithi, commended KESRA’s steady growth into a continental Centre of Excellence, recognised and certified by the World Customs Organisation (WCO) as a regional training centre for East and Southern Africa tax administrators.

“I am encouraged by KESRA’s continued collaboration with both local and international institutions, including IOM, TradeMark Africa (TMA), the Special Economic Zones Authority, the National Defence University, Jomo Kenyatta University of Agriculture and Technology, and Moi University, among others.” Said Hon. Muriithi.

KeSRA is the largest of the four accredited World Customs Organization (WCO) Regional Training Centres (RTC) in East and Southern Africa providing capacity enhancement programmes in Tax Administration, Customs Administration and Fiscal Policy.

The Chief Guest at the Graduation Ceremony, Dr James Mworia, Group CEO of Centum Investment Company Plc, emphasised the importance of digital transformation in building a transparent and responsive tax ecosystem. He lauded KESRA and KRA for championing innovation and prioritising digital skills development at a time when tax administrations globally are restructuring their operations through advanced technology.